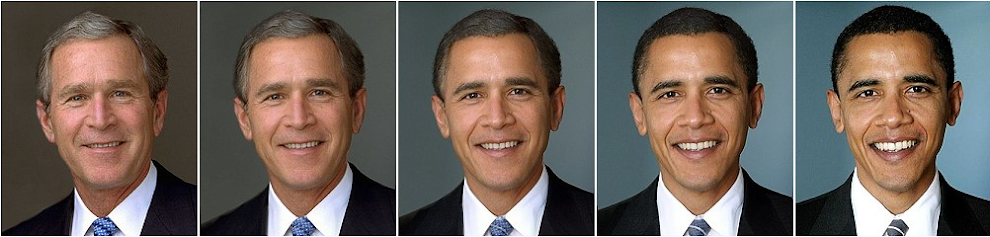

Barack Obama wants to reprise the role of the Grinch as he throws 1/2 trillion dollars from his sleigh (not counting tax cuts), back to the very people who were robbed in the first place.

Oh wait a minute, the Grinch did a much better job of returning the stolen goods to those who actually were robbed. I suppose one could say that the robbery happened under George Bush, and that Barack Obama is just picking up the pieces and "redistributing" the lost wealth as best he can.

Whatever your view of the sub-prime mortgages that first fueled, then fooled, then unspooled the economy, the one thing that stands out, and that is conveniently ignored by the elite of our society is...overnight increases in home mortgage payments that rise more than 10% are unethical, will, and did crash & burn the economy.

Instead of sub prime mortgage programs that wildly spike at the five year mark, what if the homeowners monthly payment started going up at the five year mark by just one percent (not the interest rate, but the monthly payment plus one percent, then the next month the monthly payment plus 2 percent) each month when the subprime loans vested after five years? What would have happened? Customers would have had their own built in "bailout plan" in the form of TIME.

If subprime loans SLOWLY ESCALATED the customer would have had PLENTY of TIME to sell their home if they found they could not keep up with the increasing payments.

Rather than force homeowners out of their home practically overnight, the homeowner could easily have had another six months to five years to sell their home WHILE STILL MAKING THEIR MONTHLY PAYMENTS TO THE BANKS!

Sub-prime borrowers would have made educated guesses as to how long they could afford their slowly escalating mortgages, and would have been much more likely to sell their homes in a timely fashion without being desperate when they did it. Just as importantly, the homeowner would have continued making their payments. Instead, as structured, the sub prime mortgage five year spike resulted in many homeowners simply giving up and even walking away from the home.

A SLOW ESCALATION in the monthly mortgage payment would have been a more responsible method for both stimulating the economy without it collapsing almost overnight. I believe somebody should go on trial over the design of the sub-prime mortgage program. Millions of consumers in the US and elsewhere had their sub-prime loans converted to foreclosure simply because the overnight price escalation was an abomination they could not afford.

Homeowners who bought into sub prime loans, in many instances were lured there by bankers and other money people who told them they would be foolish to not invest in a home purchase if the cost to own was not that much higher than renting. Add in the lure of rising home property values, and in most instances this was no different than entrapment.

Yes, it is possible that the sub prime mortgage industry was a plot to first falsely escalate both the economy and real estate values, and then cause the almost immediate foreclosure and LOSS of EQUITY to practically everybody in the country. Meanwhile, Credit Card Debt now remains at a record all time high as a ratio of credit card debt to total home equity in the United States. The banks appear to have won every which way even as they clamored for more bailout money.

The banks have really made out a lot better than the media tends to report. There seems to be a latent desire to scarlet letter law abiding citizens so they can be taxed and charged excessively in the future,because of past sub-prime mortgage failures. "Oh, you had a subprime loan that turned into a foreclosure? Well, you'll have to pay a penalty in the future for our fraudulent and unfair subprime loan scam that heavily contributed to your practically overnight foreclosure in the past".

Will anybody enact a law that limits how quickly a home mortgage payment can escalate from one month to the next? The sub prime loan swindlers not only got away with the past sub prime mortgage scam, they also have been given bailout money for the next great swindle as well, and the consumers that were victimized by the sub-prime loan received a scarlet letter stamped on their forehead that will cost them dearly the next time they attempt to purchase a home or buy a car.